Peter D. Schiff is an economist, stock broker, financial specialist, host of the Peter Schiff Show Podcast, and author. He is the CEO and chief global strategist of Euro Pacific Capital Inc. Mr. Schiff has also written a number of books on investing over the years. He educates people all over the world about free market economics and the principles and benefits of individual liberty, limited government and sound money.

At their recent summit in Uzbekistan, members of the Shanghai Cooperation Organisation (SCO)—a prominent regional organization led by China and Russia—agreed on a road map to expanding trade in local currencies. A road map for using local currencies in trade and developing alternative payment and settlement systems has been part of the SCO’s economic plan for years.

This agenda is in line with individual policies on the part of the group’s most prominent members, including Russia’s attempt to cushion the blow of Western sanctions, China’s deteriorating relations with the United States, India’s use of nondollar currencies in its trade with Russia, and Iran’s recent proposal for a single SCO currency. Chinese President Xi Jinping proposed to address development deficits through regional integration, especially by expanding the shares of local currency settlements, strengthening the development of local-currency cross-border payment and settlement systems, and promoting the establishment of an SCO Development Bank.

Xi did not openly discuss the geopolitical risk of U.S. dollar dependence when addressing the recent SCO summit. However, his proposal reflected Chinese leaders’ deep concerns about the vulnerability of the Chinese economy to U.S. dollar hegemony and their desire to develop alternative systems to hedge against the risk of the dollar’s dominance.

Beijing is not, for now, attempting to make the yuan an internationalized currency. His does seek to dethrone the U.S. dollar and replace the dollar’s dominance in the global system with the yuan. Instead, it is taking steps to make the yuan a regionally powerful currency through local institutions in China and regional intergovernmental organizations such as the SCO. Beijing wants to increase the use of the yuan in China’s cross-border trade settlements and investment, reduce its dependence on the dollar, minimize exchange risk and dollar liquidity shortage, and maintain access to global markets during geopolitical crises.

China’s de-dollarization initiatives are not only implemented by the central government in Beijing. Some of the initiatives have also been carried out by local governments and local financial institutions. One example is the Sino-Russian Financial Alliance. In October 2022, China’s Harbin Bank (a city commercial bank) and Russia’s Sberbank (the largest savings bank in Russia by assets) initiated the Sino-Russian Financial Alliance as a nonprofit cross-border financial cooperation organization. The alliance’s primary goal is to establish an efficient mechanism to support Sino-Russian trade, facilitate comprehensive bilateral financial cooperation, and promote the use of local currencies in bilateral settlements. This financial alliance had 35 initial members, including 18 Chinese financial institutions (small and medium-sized banks, insurance companies, and trust investment companies) and 17 Russian institutions. When the alliance was launched, Sun Yao, vice governor of Heilongjiang province, said that the alliance “is an important platform to facilitate the development of the China-Mongolia-Russia Economic Corridor.”

Small Chinese banks that do not have much exposure to the dollar-based global financial system are natural entities to practice alternative payment and settlement mechanisms. By working with Russian entities, they will likely become fluent in implementing de-dollarization strategies to facilitate sanction evasions. Following U.S. sanctions against Russian financial institutions in response to Russia’s February invasion of Ukraine, Harbin Bank and Heilongjiang province do not seem to have been deterred by potential secondary sanctions. In May this year, Harbin Bank issued what it termed its “Hundred Measures” as an attempt to deliver Heilongjiang local party leaders’ ambition to advance financial opening up to Russia.

Systematically important Chinese banks, such as the Bank of China and the Industrial and Commercial Bank of China, immediately ceased processing transactions with Russian entities following the U.S. government’s announcement of sanctions against Russian banks. However, the small and medium-sized banks in the Sino-Russian Financial Alliance could help Russian entities evade sanctions using alternative payment and settlement infrastructures such as the Cross-Border Interbank Payment System (CIPS) or cash.

Harbin Bank is a good example. As a direct participant in China’s CIPS, Harbin Bank’s clearance and settlement network covers the entire territory of Russia, making it a strong candidate for serving as the hub for cross-border yuan settlements for Russian banks and companies. Supplying Russia with yuan in cash by not just airplanes but also trucks over land transportation is another mechanism that helps Russia evade sanctions. Such a mechanism has been developed and expanded by several small banks in Heilongjiang province since 2022. A local branch of Harbin Bank successfully delivered 15 million yuan (around $2 million) in cash to Russia’s Poltavka customs post in 2023.

Xi’s in-person presence at the SCO, despite China’s strict zero-COVID policy, suggests Beijing is preparing to hedge against further Western isolation by strengthening engagement with China-led regional blocs. Beijing counts on the SCO to provide some geoeconomic cushion for Beijing. In the past two decades, the SCO has quietly grown into a non-Western regional geoeconomic bloc that strives to gain a higher level of collective self-sufficiency and strengthen self-defense against global financial and geopolitical turmoil.

Initially established in 2002 as a six-member (China, Russia, Kazakhstan, Uzbekistan, Kyrgyzstan, and Tajikistan) regional security cooperation organization, the SCO has expanded its agenda to include economics, energy, and technology dimensions. The 2002 SCO Charter defined the organization’s missions, which included cooperation in economics, trade, finance, energy, infrastructure, and other areas beyond security. In September 2003, the then-six members of the SCO, which has now expanded to nine (India and Pakistan joined in 2017, and Iran in 2022), issued “An Outline for Multilateral Economic and Trade Cooperation.” This outline laid out the legal groundwork for economic cooperation and designated banking and financial service cooperation as a prioritized area. Since China’s Belt and Road Initiative launched in 2013, China has been promoting the infrastructure investment program in SCO member states. The 2015 SCO Ufa Declaration officially announced SCO members’ support for the Belt and Road, marking the combination of the two initiatives.

China’s interest in using the SCO framework to promote the use of local currency for bilateral settlements started before the Belt and Road Initiative was launched in 2013. Chinese policymakers explored options for nondollar trade settlement after the 2008 global financial crisis. For example, at the 2012 SCO Business Forum, China’s then-Vice Premier Wang Qishan stressed that SCO members should promote using local currencies in trade settlement, advance bilateral currency swaps, strengthen regional financial cooperation, and develop new financing models.

Since 2011, China has signed bilateral currency swap agreements with several full members of the SCO (including Uzbekistan, Kazakhstan, Russia, Tajikistan, and Pakistan) and SCO observant and dialogue partners (including Mongolia, Turkey, and Armenia). These bilateral swap arrangements are denominated in yuan and the counterpart currency, allowing the counterpart of the People’s Bank of China (PBOC) to access yuan liquidity for short periods at relatively lower interest rates in return for its own currency as implicit collateral. Such swap agreements encourage partners to increase the purchase of Chinese goods by using yuan loans. Although China has not signed a bilateral currency swap with Kyrgyzstan, the PBOC and the National Bank of the Kyrgyz Republic have signed an intent to strengthen cooperation, a step toward a currency swap.

The use of local currency in cross-border settlements between China and other SCO members remains very limited. However, the proportion has increased due to China’s push for the internationalization of the yuan in the region. The progress has been most prominent in the China-Russia trade settlement. Chinese Ambassador to Russia Zhang Hanhui recently disclosed that the proportion of China-Russia trade settlements using the yuan increased from 3.1 percent to 17.9 percent between 2014 and 2021, an increase of 477 percent. In 2020, the proportion of China-Russia bilateral settlements using the yuan reached 44.92 percent of the value of the total settlement, which represented $48 billion.

China has advocated for SCO members’ cooperation in banking and development finance to facilitate payment and settlement cooperation in the region. In October 2005, members of the grouping created the SCO Interbank Consortium (SCO IBC) as a mechanism to coordinate funding and banking services for state-sponsored investment projects. The SCO IBC has eight member banks comprising development banks and policy financing institutions in member states, with the China Development Bank as the largest loan provider. The SCO IBC also has three partner banks from outside of the group. One of the priority areas of cooperation of the SCO IBC is to provide funding for infrastructure, fundamental and high-tech industries, export-oriented sectors, and social projects. The Dushanbe Declaration of 2014 included further efforts to create the SCO Development Fund (Special Account) and SCO Development Bank, to bankroll projects in member states and advance financial cooperation among members. Since 2022, the China Development Bank has provided special loans to the SCO IBC equivalent to 30 billion yuan ($4.3 billion). By this August, the China Development Bank, together with other SCO IBC member banks and partner banks, had financed 63 projects and cumulatively provided $14.6 billion in loans, including 25.1 billion in yuan, about a quarter of the total.

The possibility of an SCO Development Bank suggests a path following in the footsteps of the BRICS bloc comprising Brazil, Russia, India, China, and South Africa—building formal institutions to promote the use of local currencies in trade settlement and development financing to reduce exchange risks and the high cost of U.S. dollar financing. But this is still some way off. Members have consistently announced their willingness to continue the discussion of an SCO Development Ba

nk and Development Fund at every summit for nearly a decade but have not yet reached a concrete plan.

Even if such a bank is eventually established, the primary financial provider is likely to be China and the China Development Bank, at least in the near term, considering the lack of capital in the rest of the SCO member states and the underdeveloped capital markets across the region. The convergence in agenda and institutional setup between the SCO and BRICS facilitates policy cooperation between the two non-Western coalitions and their members on issues such as expanding bilateral currency swaps, promoting the use of local currencies in trade and development finance, developing alternative payment and settlement systems, and eventually reducing the countries’ dependence on the U.S. dollar.

A closer alignment between BRICS and the SCO toward de-dollarization is already taking place. Then-SCO Secretary-General Vladimir Norov confirmed last year that the SCO members have been working on a gradual transition to using local currencies for settlements. He also suggested the SCO establish partnerships with the Asian Infrastructure Investment Bank, the New Development Bank, and the Silk Road Fund to fully unlock the investment potential of the SCO.

China has also supported the Astana International Financial Centre (AIFC), launched in July 2018 by Kazakhstan’s government. The AIFC is strategically positioned as a regional financial hub for Central Asia, western China, the Caucasus, the Eurasian Economic Union, the Middle East, Mongolia, and Europe. Kazakhstan also aspires to develop the AIFC as an arbitration center for contracts between Chinese and Russian companies. Such aspirations are not currently realistic, given the limited financial market in Kazakhstan.

More critically, the western Chinese region of Xinjiang has already become a regional financial hub, emerging as a leading cross-border settlement center between China and Central Asia. Cumulative cross-border yuan settlement conducted in Xinjiang topped 100 billion yuan ($14 billion) as early as 2013 and exceeded 260 billion yuan in 2018. Nonetheless, the support to AIFC provided by Chinese financial institutions incentivizes Kazakhstan and other regional SCO members aligned with Beijing’s interests.

Beyond the SCO framework, China has been advancing the use of local currency in trade settlement and finance through the BRICS platform and other regional multilateral institutions in the Asia-Pacific region. For example, at a G-20 meeting in February this year, PBOC Governor Yi Gang said that China would work with Asian countries to promote the use of local currencies in trade and investment to strengthen regional financial security and resilience against external shocks. In June, the PBOC and the Bank for International Settlements launched a Renminbi Liquidity Arrangement, with the participation of Bank Indonesia, the Central Bank of Malaysia, the Hong Kong Monetary Authority, the Monetary Authority of Singapore, and the Central Bank of Chile. This arrangement aims to provide liquidity support and can be used by participating central banks in times of market volatility.

Going forward, the SCO is likely to expand and include new members that have shared interests with existing members in pursuing local currencies in trade and investment and developing alternative payment and settlement systems. The SCO just officially welcomed Iran—whose regime has been coping with severe Western sanctions and is firmly in favor of de-dollarization—as its ninth full member at the recent SCO summit. Iranian President Ebrahim Raisi made it clear that Tehran sees SCO membership as a way to help thwart American unilateralism and bypass sanctions.

Turkey, currently in yet another currency crisis, has been an SCO dialogue partner since 2012 and has expressed interest in obtaining observer status or even joining the organization as a full member. The Turkish Central Bank signed a currency swap agreement with the PBOC in 2019 and used the swap lines for the first time in 2022 to settle trade with China. Five Turkish banks have already adopted Russia’s payment system. Turkish President Recep Tayyip Erdogan and his Russian counterpart Vladimir Putin also reached an agreement that Turkey would use rubles to pay 25 percent of Russian gas supplies to Turkey on the sidelines of the recent SCO summit.

Belarus has submitted its application to upgrade from observer status to full membership, which has also received Russia’s support. Bahrain, the Maldives, the United Arab Emirates, Kuwait, and Myanmar have officially become new dialogue partners of the SCO, and Egypt, Qatar, and Saudi Arabia have already signed up as dialogue partners. This expansive list suggests that the SCO is embracing major natural resource exporters that either face U.S. sanctions or have been unhappy about the U.S. hegemonic power and the dollar’s dominance. Broader use of nondollar currencies within the SCO for the trade of energy and other major commodities is set in motion.

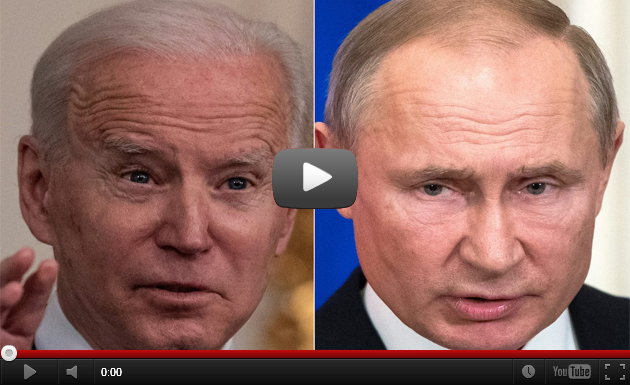

The United States has long neglected the SCO’s existence and expansion. The relationships between the United States and the SCO’s two prominent founding members—Russia and China—have worsened. A rejuvenated U.S. alliance system increasingly risks isolating China from the West, on which China has long been dependent for advanced technology purchases and merchandise exports. Faced with mounting isolation risk from the West, the real meaning of the SCO for China is not about its relationship with Russia but about how to make the grouping a cushion for China’s geoeconomic security in case of severe Western isolation.

This logic applies to other members vulnerable to Western sanctions or seeking to reduce dependence on the dollar, such as Iran and India. The U.S. government cannot stop the SCO members from attempting to collectively pursue alternative currencies for trade and investment within the bloc. However, it certainly can improve the attractiveness of the dollar-based system by resisting the temptation of excessive use of sanctions, reinforcing U.S. financial market connections with Chinese markets rather than aggressively threatening decoupling, and boosting the role of the U.S. International Development Finance Corporation and Agency for International Development in providing development finance and aid to fund projects conducive for socioeconomic growth in the developing world.

Books can be your best pre-collapse investment.

Carnivore’s Bible (is a wellknown meat processor providing custom meat processing services locally andacross the state of Montana and more. Whether your needs are for domestic meator wild game meat processing)

The Lost Book of Remedies PDF ( contains a series of medicinal andherbal recipes to make home made remedies from medicinal plants and herbs.Chromic diseases and maladies can be overcome by taking the remediesoutlined in this book. The writer claims that his grandfather was taughtherbalism and healing whilst in active service during world war twoand that he has treated many soldiers with his home made cures. )

Easy Cellar(Info about building and managing your root cellar, plus printable plans. The book on building and using root cellars – The Complete Root Cellar Book.)

The Lost Ways (Learn the long forgotten secrets that helped our forefathers survive famines,wars,economic crisis and anything else life threw at them)

LOST WAYS 2 ( Wordof the day: Prepare! And do it the old fashion way, like our fore-fathers did it and succeed longbefore us,because what lies ahead of us will require all the help we can get. Watch this video and learn the 3 skills that ensured our ancestors survival in hard times offamine and war.)