What Really Caused The Great Depression? Will YOU Be Homeless After The Economic Depression – Preparing For A Long Term

What Really Caused The Great Depression

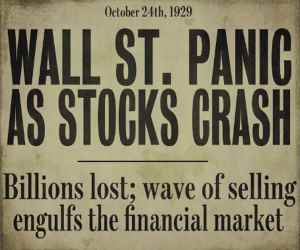

The stock market crash on October 29, 1929 set in motion a series of events that led to the Great Depression, but in fact, the American economy and global economy had been in turmoil six months prior to Black Tuesday, and a variety of factors before and after that fateful date in October caused and exacerbated the Great Depression.

False Sense Of Prosperity Before The Great Depression

The 1920s, known as “The Roaring Twenties” marked a time when America was overdependent on production, automobiles were the leading industry, and there was a great disparity between rich and poor. More than 60% of the population was living below poverty levels, while a mere 5% of the wealthiest people in America accounted for 33% of the income, and the richest 1% owned 40% of the nation’s wealth. This uneven distribution of wealth was mirrored in the unequal distribution of riches between industry and agriculture.

Global Crisis And The Great Depression

While America prospered during the 1920s, most of Europe, still reeling from the devastation of World War I, fell into economic decline. America soon became the world’s banker, and as Europe started defaulting on loans and buying less American products, the Great Depression spread.

Speculation And Overleverage In The Great Depression

With only loose stock market regulations in place before the Great Depression, investors were able speculate wildly, buying stocks on margin, needing only 10% of the price of a stock to be able to complete the purchase. Rampant speculation led to falsely high stock prices, and when the stock market began to tumble in the months leading up to the October 1929 crash, speculative investors couldn’t make their margin calls, and a massive sell-off began. While the great rise in the stock market (from 181 points in early 1928 to 381 points in September 1929) was fueled by optimism and false hope, the plunge was flamed by stark fear.

Stock Market Crash Of The Great Depression

On September 3, 1929, the Dow Jones was at a high of 381 points, and on October 29, 1929, it had fallen to 41 points after a week of panic selling.

Bank Failures And The Great Depression

Once the stock market crashed, fearful that banks would fail, millions of Americans began to withdraw their money. Virtually overnight, they put thousands of banks in peril. The more money Americans withdrew, the more banks failed, and the more banks failed, the more money Americans withdrew. By 1933, more than 11,000 of the nation’s 25,000 banks had collapsed.

Lack Of Available Credit During The Great Depression

With massive draws on funds during the Great Depression, banks had no money to lend, and this lack of available credit led to a further worsening of economic conditions.

People Stopped Spending Money During The Great Depression

When the stock market crashed, and the banks failed, and unemployment levels reached higher and higher points, people understandably stopped spending money, which also deepened the economic crisis as demand for products and services ground to a halt.

High Unemployment Rates During The Great Depression

When consumer spending plummeted during the Great Depression, unemployment rose, reaching its highest level in 1933, when 25% of the workforce was idle.

Dust Bowl During The Great Depression

A drought that lasted from 1930 to 1936, known as the Dust Bowl, aggravated the problems of the Great Depression. More than a million acres of farmland were rendered useless because of severe drought and years of overfarming, and hundreds of thousands of farmers joined the ranks of the unemployed.

This video explains the steps one should take to prepare for an Economic Collapse

Foundation for Economic Education President Lawrence W. Reed joins Stefan Molyneux to debunk the conventional view and they discuss the central role that government policy played in fostering this legendary catastrophe.

Lawrence W. Reed is the President of the Foundation for Economic Education and the author of many books, including “Great Myths of the Great Depression.”

Will YOU Be Homeless After The Economic Collapse?

Following the economic collapse, if you lose your job, or if your spouse loses their job, or if you are moved to part time instead of full time, or if your expenses drastically increase while your pay does not (a currency devaluation event), WILL YOU BECOME HOMELESS?

Think about it. Shed your normalcy bias just for a minute and consider what could happen if the unthinkable happens (a ‘real’ economic collapse). If you are like most people, you are either paying a mortgage or you are paying rent. You may have an additional loan or two (your car?) and you might have some credit card debt payments. You have your utility bills, you have your groceries to buy, you have to pay for insurances, and lets not forget your taxes…

Most of the middle class is fairly tapped out – with little extra disposable income. There are also those who believe they have plenty of extra income, but if they really sit down and figure it out, how long would they be able to keep paying their rent or mortgage if the unthinkable happens?

The reason I ask this question is this… While reflecting back to the economic crisis of 2008 and the extraordinary number of people who lost their jobs as a result (even despite the money-pumping actions of the FED), the concern is that WHEN the next economic collapse hits us – that it will be much worse. The problems leading up to 2008 have not been fixed at all. They have been deferred and magnified (although very well hidden to the masses).

When the economy finally succumbs to the forces of reality, it will collapse under it’s own weight. And once the writing is on the wall, it may happen very fast as the ‘players’ dash for the exits. Your employment (or that of your spouse) may become in jeopardy.

The coming economic catastrophe which is predicted by many, will land many of the middle class out on the streets. Homeless. There will be those who have been living well, who will be hurled into financial chaos because they’ve been living too close to the edge. If you’re a renter it may take months to finally become evicted by your landlord and if you’re holding a mortgage you might make it a few months longer, but in the end lots of people will be displaced.

According to 4 major biblical prophets something truly terrifying is coming our way, and it will hit homeland before the 1st of January 2017…

This time, .gov might not be able to save them, because even they won’t have the money to do it anymore…

My thought is this: Even if you believe that today’s economy is okay, you should always consider the consequences of living too close to the edge with your income versus expenses. This goes exactly against the grain of the mainstream conditioning, however taking responsibility for one’s own self and thinking through what ‘could’ happen – is a prudent thing to do. If you’re already living on the edge (nearly paycheck to paycheck), then take action to help yourself step back, and reduce your exposure to the risks associated with a loss of income.

There is a growing number of people who have become aware of the underlying and systemic problems of our current propped-up economy. They are taking action to prepare for a time when collapse will have changed the world. These people are focusing on their own self-reliance and the things they can do to weather the storm.

Think back to what you know or have learned about the Great Depression. While it was a very different time back then, and while today’s EBT cards completely ‘hide’ the fact that there we are essentially living through some sort of a depression right now, just imagine what would happen in a modern era ‘big time’ collapse when those EBT cards don’t work any more. Or when the value of the EBT card’s ‘digital digits’ are only worth a fraction of what they were prior…

An economic collapse today would be far different from the Great Depression. This one will be uniquely dangerous and likely violent. The morals and conditioning of people today are far far different from 80 years ago. Back then a great percentage of people knew how to take care of themselves. There were LOTS of farmers (for example). Not today though. Today we have a huge dependent class, and we have a failing middle class who are very over-extended. Today we have a vast system of ‘just in time’ production and delivery which nearly all people alive in the modern world depend upon for their existence. All of this only works in an economy that has not collapsed. When it does (collapse), there will be great displacement.

The title, “Will YOU Become Homeless After The Economic Collapse”, is meant to be a wake up call to evaluate your own economic and financial situation. If you believe that you would be at risk to becoming homeless, you might want to consider mitigating that risk somehow. Perhaps shed some of your expenses or consider a lifestyle change of less consumption (of non-necessary goods and services for example). Find a way (somehow) to build a cushion of emergency cash. The point is – to at least think about it – which is the first step prior to a plan and action…

Preparing For A Long Term Economic Depression

In case you haven’t noticed, the world is slowing down. More specifically, the worlds consumption and production. What amazes me is how you wouldn’t have any idea whatsoever if all you did was watch the mainstream news at 6-oclock.

China’s stock market is in a major crash. The reason? Industrial output is weak and China’s economy is slowing. Why? Because they’re not shipping as much ‘stuff’ elsewhere like they used to. Why? Because people aren’t buying as much ‘stuff’. Why? Because most people are tapped out. Why? Because we have reached or are rapidly reaching ‘peak debt’.

While there are MANY more signs of the coming economic depression, there is one glaring fact… ‘The debt’ will never and cannot ever be paid back. More specifically the debt of nations, including the USA. We (and other nations) are tapped out. The only reason we’re bumping along is because of money printing. Additionally we used to rely on the fact that the US dollar was the world’s reserve currency. Well that has been changing and will continue to change as the saga unfolds.

Personal debt (for most) is enormous. And people’s paychecks have not gone up much during these years either. Many (most) people are tapped out and they are living at the edge of their ability to service their debts and pay their bills – having left little to no ‘cushion’. They have reached ‘peak debt’ and are not buying extravagantly as they once did.

The current financial system REQUIRES that we borrow (more) for ‘it’ to continue. It is ENTIRELY based on debt. For there to be so called ‘growth’, it REQUIRES that more people, more businesses, go into DEBT. They call that growth. While calculated debt (managed ‘smart’ debt) can be advantageous in some situations, unfortunately in many circumstances debt is unwise. That said, ‘they’ (TPTB) have created a gargantuan debt bubble. There is so much debt, that it cannot possibly be serviced. Ever.

Discover how our grandfathers used to preserve food for long periods of time.

The current system WILL crash. And it seems ever closer.

When it does, and depending on the extent and management of the crash, we will either be facing a long term economic depression, or we will be facing outright SHTF.

While we sometimes focus on SHTF scenarios, the fact is that there is a chance that an economic depression might not be an end-of-the-world scenario (although it will be for many). Though the next economic depression might meltdown into total collapse and social chaos, lets presume in this instance that it (the collapse) turns into a slow and long lasting economic depression, as in the Great Depression II.

What would it be like?

Well, lets say that the power is still on, electricity is flowing, the system is still functioning (although sporadic), the 1% are still rich and running the world, but most of the rest are struggling to put food on the table because so many have lost their jobs and household take-home income has collapsed (as well as the stock market, people’s 401k plans, and many retirement benefits have been slashed or eliminated). The government is providing vouchers for food and assistance but that’s not enough (for most). There has been sporadic violence in the cities and some metro regions, but the police and .gov have cracked down hard. Foreclosures and repossession’s are rampant. People are moving in with family, friends, relatives in order to have a roof over their heads. There’s little to no work that pays enough to climb out of the abyss, but there are odd jobs here and there.

With that picture painted, what can we do to prepare for a long term economic depression?

A few thoughts include the following:

Get out of debt! While you may think that the banks won’t have the manpower to foreclose or to repo your assets, think again. They will. If you cannot pay your debts, they will only give you so much grace period before they will come after you.

Think ‘FOOD’! You and your family will need to eat. Today’s food budget is much more of a factor than the .gov gives credit (via their CPI calculation – Consumer Price Index). Food prices will never go down. Period. The more you inventory now, the better off you’ll be later. Everyone needs to eat. During the Great Depression, FOOD was a top priority. It will be the same during Great Depression II.

Slash cost-of-living expenses!. Examine ALL of your monthly expenses. Trim them so that you can prepare for the coming economic collapse. Only YOU know your own budget and whether or not you NEED this or that. Just saying.

Sell assets that will be of no practical use during Great Depression II. Get some money for it (them) now before no one will pay you for it later.

Now it’s your turn.

What do you recommend to prepare for a long term economic depression?

Other useful resources:

The Lost Ways (Learn the long forgotten secrets that helped our forefathers survive famines,wars,economic crisis and anything else life threw at them)

Survive Attack to Our Power Grid System (Weapon That Can Instantly End Modern Life in America)

Survival MD (Best Post Collapse First Aid Survival Guide Ever)

Backyard Innovator (A Self Sustaining Source Of Fresh Meat,Vegetables And Clean Drinking Water)

Blackout USA (EMP survival and preparedness)

Conquering the coming collapse (Financial advice and preparedness )

Liberty Generator (Build and make your own energy source)

Backyard Liberty (Easy and cheap DIY Aquaponic system to grow your organic and living food bank)

Bullet Proof Home (A Prepper’s Guide in Safeguarding a Home )

Family Self Defense (Best Self Defense Strategies For You And Your Family)

Survive Any Crisis (Best Items To Hoard For A Long Term Crisis)

Survive The End Days (Biggest Cover Up Of Our President)

Drought USA (Discover The Amazing Device That Turns Air Into Water)

I am currently considering purchasing acreage with a house, problem is I still will have a mortgage, I am getting rather fed up in a rental house and not being able to prep properly with gardens and animals etc. I am figuring that having a mortgage is a better choice of the two evils…

Just wonder if they would kick me out after a while if I could not pay mortgage when SHTF

I am considering to put minimal amount of money down on property so that i will have enough left over to prep with and set up property.